Have a small side business? Disclose it to your Loan Officer

St Paul, MN: It is a pretty well know that when buying a home and applying for a home mortgage loan these days, mortgage companies are asking for more information from the applicants.

Standard items include photo ID, last 30-days of pay stubs, last two years W2′s, and your last two months of bank statements. What is less known are some of the additional requirements that can quickly derail your pre-approval.

When taking your application, your Mortgage Loan Officer will ask details about your employment. If your job is paid hourly or salary, the lender does NOT need a copy of your Federal Tax Returns, so of course they would not ask you to provide them.

If you are self-employed, get tips, or commission income – your last two years of tax returns ARE required, so the Loan Officer will ask you to provide them right away.

But what if you have a small side business? It is likely you didn’t mention it. How about the spouse? Do they have a small side business. Mary Kay, Tupperware, or maybe Lia Sofia?

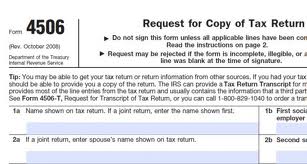

The 4506T: All mortgage applications now require the applicant to sign an IRS 4506T. This document allows the mortgage lender to obtain a copy of your Federal Tax Returns.

They are looking for any discrepancies between what you told the lender and what you reported to the IRS.

Deal Killers: I recently Pre-Approved a couple. Only the husband and his salary job were listed on the application, but the loan was denied a week before closing when we discovered the wife reported a $15,000 loss on their joint tax return for her jewelry business.

Any side business losses will by underwriting be assumed to continue. Therefore in this case, I was forced to reduce the husbands income by $15,000 a year, which caused them to exceed debt-to-income ratios and have thier mortgage loan application denied.

This particular couple lost the dream house they were trying to buy. In the end, they were able to buy and close on a slightly less expensive home, based on their actual situation. Had this business loss been known in the beginning, they could have focused their home search on the correctly priced home, and saved a lot of time and headache.

The Bottom Line: If it is on your tax return, the lender is going to know it . Disclosed everything up front to your Loan Officer, no matter how trivial it may sound to you.